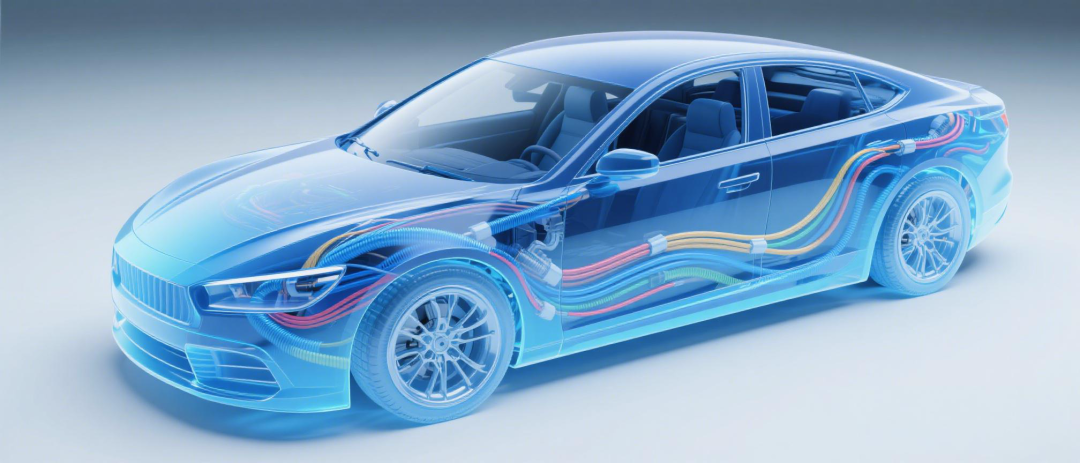

As the "neural network" of a vehicle, automotive wiring harnesses carry the crucial mission of power transmission and signal interaction. Their technological evolution directly impacts a vehicle's energy efficiency, cost, and level of intelligence. In recent years, this industrial revolution surrounding wiring harnesses has evolved from an initial focus on simply "reducing length" to a systematic restructuring based on "setting standards," profoundly changing the development landscape of the global automotive industry.

"Reducing length": The 1.0 breakthrough in wiring harness technology

In the distributed architecture of traditional fuel vehicles, each functional module is equipped with an independent ECU, resulting in a total vehicle wiring harness length of up to 5 kilometers. This not only occupies a large amount of space but also becomes a critical bottleneck limiting vehicle lightweighting and energy efficiency improvements. The emergence of Tesla broke this deadlock, initiating a "length reduction" revolution through architectural innovation: the Model S/X reduced the wiring harness to 3.5 kilometers, the Model 3 further reduced it to 1.5 kilometers, and the Cybertruck achieved a leapfrog breakthrough of 0.5-1 kilometers, a 77% reduction compared to traditional models.

The core of this "slimming down" movement lies in three main technological paths: firstly, architectural innovation, shifting from a distributed to a domain controller architecture, integrating more than 70 dispersed ECUs into four major domains: driving, power, chassis, and cockpit. The latest zonal architecture further divides control units by physical location, reducing the wiring harness by another 30%; secondly, connector simplification, unifying more than 200 types of interfaces into 6 standard types, meeting over 90% of transmission needs and significantly reducing design complexity and error rates; thirdly, wiring optimization, through the close proximity layout of control units and actuators, combined with 3D simulation to plan the shortest path, completely eliminating redundant wiring.

The value brought by "length reduction" is multidimensional: in terms of weight reduction and efficiency improvement, the wiring harness accounts for 3-5% of the total vehicle weight. In one model, the weight reduction of the wiring harness directly improved the driving range by 3%. The Leapmotor "Clover" architecture's wiring harness weighs only 23kg, a reduction of 15kg compared to traditional models, significantly improving handling; in terms of cost control, material costs are reduced due to less copper usage, and shortened assembly time promotes increased automation, resulting in a 10-15% reduction in overall vehicle costs and a more than 20% increase in production efficiency.

"Setting Standards": The 2.0 Deepening of the Wiring Harness Revolution

With the popularization of "length reduction" technology, the industry has gradually realized that the lack of unified standards has become a new bottleneck restricting the large-scale application of the technology and cross-enterprise collaboration. Consequently, the wire harness revolution has moved from simple technological optimization to a systematic deepening stage of "setting standards," and building a unified and standardized system has become an industry consensus.

In terms of standard system construction, both domestic and international efforts are accelerating: At the national level, the "Energy-Saving and New Energy Vehicle Technology Roadmap 2.0" clearly proposes achieving a 90% standardization rate for high-voltage wire harness interfaces and a 100% application rate of lightweight materials by 2030. The national standard GB/T 20734-2022 "Technical Conditions for Automotive Wire Harnesses" comprehensively standardizes indicators such as insulation, voltage resistance, and safety; at the international level, the ISO 19642 high-voltage wire harness testing standard and the LV215 low-voltage EMC standard have become global benchmarks, while the SAE and USCAR series standards promote the interoperability and reliability of wire harnesses.

Breakthroughs in standards in key areas are particularly significant: In the high-voltage platform, the 800V high-voltage platform has become an industry consensus. Unified high-voltage interface standards not only reduce wire harness diameter and improve transmission efficiency but also solve charging compatibility problems; in material standards, "aluminum replacing copper" technology has achieved a major breakthrough. Aluminum density is only 1/3 of copper, reducing costs by 40%. The conductivity gap is compensated by increasing the cross-sectional area (reaching 64% of copper). Standards for lightweight materials such as carbon fiber sheaths and thin-wall insulation are also gradually improving, enabling wire harness weight reduction of up to 30%; in the field of high-speed data transmission, automotive Ethernet achieves 100Mbps to 10Gbps transmission with a single pair of unshielded twisted-pair cables, at only 1/3 the cost of traditional LVDS, and the microsecond-level synchronization standard of TSN (Time-Sensitive Networking) meets the real-time requirements of autonomous driving.

Breaking through barriers and innovating with the power of China.

In the global automotive wiring harness revolution, Chinese companies are transforming from "followers" to "leaders," occupying key positions in industrial competition through technological breakthroughs and participation in standards setting.

In the core technology of "aluminum replacing copper," Chinese companies have achieved large-scale breakthroughs: Huguang Co., Ltd. was the first to apply aluminum wiring harnesses to passenger cars, breaking the monopoly of foreign companies; TE Connectivity and Boway Alloy collaborated to overcome the challenges of aluminum-copper electrochemical corrosion and creep performance, reducing copper content in low-voltage signal lines by 60%, weight by 30%, and cost by 10%. It is estimated that the large-scale application of this technology could reduce CO₂ emissions by approximately 850,000 tons annually and open up a market space of 36-48 billion yuan.

In terms of standard setting, Chinese companies' influence continues to increase: the "General Requirements for Automotive Low-Voltage Wiring Harness Processing Centers" led by Haiprui has been officially implemented; the independent architectures launched by companies such as BYD and Leapmotor provide a new paradigm for industry standards; and Chinese companies are more deeply involved in the development of high-voltage wiring harness safety standards in the ISO/TC22 working group, translating technological practices into industry rules.

Innovative technological routes are constantly emerging: Geely and TE Connectivity have collaborated to develop flexible flat cables (FFC) to replace traditional wiring harnesses, reducing weight by over 50%; the BMW iX is piloting the application of Bluetooth + UWB technology to unlock car doors, reducing 12 wiring harnesses and 0.8 kg in weight, providing valuable experience for the exploration of "wireless wiring harnesses."

From "Simplification" to the Ultimate Evolution of "Zero Wiring Harnesses"

The ultimate goal of the automotive wiring harness revolution is to achieve the ideal state of "zero wiring harnesses." Tesla has clearly set a technical target of 100 meters of wiring harnesses, completely reconstructing the vehicle's "neural network" by integrating wiring harnesses into the vehicle structure, combined with regional controllers, wireless communication, and fiber optic transmission technology.

This revolution brings not only technological iteration but also a comprehensive transformation of the industrial ecosystem: wiring harness suppliers need to transform from traditional manufacturing to "system integration + software development," deeply participating in the overall vehicle architecture design; vehicle manufacturers will prioritize wiring harness planning, achieving synchronous development with the body and electronic systems; and the repair system will also achieve precise fault location through modular design, significantly improving repair efficiency. According to industry plans, the standardization rate of high-voltage wiring harness connectors will reach 50% by 2025, increase to 80% by 2028, and achieve a 90% standardization target by 2030, with lightweight materials being fully adopted. At that time, wiring harnesses will no longer be a bottleneck restricting automotive development, but rather a core support enabling electrification and intelligent upgrades.

From a single-point breakthrough of "reducing length" to a systematic restructuring of "setting standards," the automotive wiring harness revolution is essentially an industrial upgrade centered on efficiency, cost, and safety. For China, seizing the two major opportunities of "aluminum replacing copper" technology breakthroughs and standard setting, and continuously deepening innovation, is expected to enable it to take a leading position in the new round of global automotive industry competition, injecting strong momentum into the high-quality development of the automotive industry.